William_Potter/iStock via Getty Images

Investment thesis

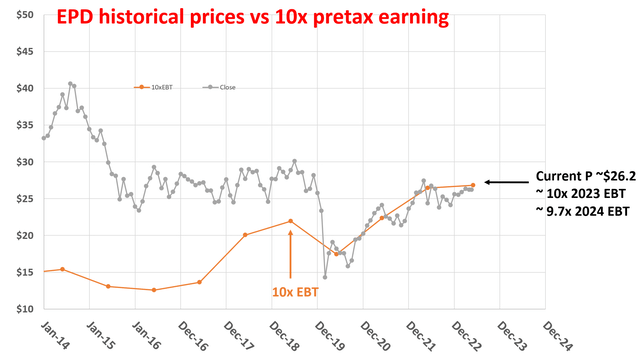

Recently, the stock prices of Enterprise Products Partners (NYSE:EPD) have experienced some corrections due to fluctuations in oil prices. And the thesis is to explain why I believe its current prices underestimate its true earning potential according to Buffett's 10xEBT rule. According to this rule, buying a stock at a price of 10x earnings before taxes ("EBT") with good earnings consistency is equivalent to owning an equity bond with a 10% yield. Any earnings growth will be a bonus and push the total return potential into double digits.

Next, we will see that EPD is trading at almost exactly 10x of its 2023 EBT, and only 9.7x of its 2024 EBT. As such, EPD is poised to provide a 10% total return even if earnings stagnate. Yet, my outlook for its earnings is the opposite of stagnation. Historically, EPD has been growing its distributions (the best proxy of its owners' earnings in my view) at a healthy pace and with impressive consistency. It has grown its distributions at a CAGR of 4.0% in the past 10 years and 2.5% in the past 5 years. It even kept consistency during the COVID-19 pandemic, which crushed the energy market and caused most MLPs to eliminate or sharply reduce their distributions.

Looking forward, I see a few near-term and mid-term catalysts working for EPD to maintain its growth. And as to be elaborated later, these catalysts include the supply-demand imbalance in the energy sector and also possible bolt-on acquisitions.

EPD and Buffett's 10xEBT Rule

If you're a Warren Buffett fan like me, you've probably noticed that many of his successful investments were made at or below 10xEBT. He picked winners like Coca-Cola, American Express, Wells Fargo, and Apple more recently. It's not a coincidence as analyzed in my blog article. Buffett certainly knows that pretax earnings matter more because taxes can be managed, and it's easier to compare pretax earnings to bond yields, which are quoted before taxes.

Now, specific to EPD, the market is currently valuing it at almost exactly 10x of its 2023 EBT as seen in the chart below. In terms of its 2024 FWD earnings, it is trading at only 9.7x EBT. You can also see the value of the 10xEBT rule in the opposite direction: guarding investors against paying too much for a good stock - even a dividend champ like EPD. The stock has been trading at multiples way above 10x EBT before 2018 and history has shown how bad an idea it was to chase the stock at those multiples. From 2018~2018, the valuation bubble started deflating, and the deflation was completed (and overdone) during 2020. Its multiple has been fluctuating closely around the 10xEBT line since then. As seen, whenever the market price falls close to or below the 10xEBT line, it has been a good time to buy. And vice versa.

In the next section, I'll further detail these results and explain what all this means for further expected returns.

Source: author based on Seeking Alpha data

EPD's tax rates and valuation multiples

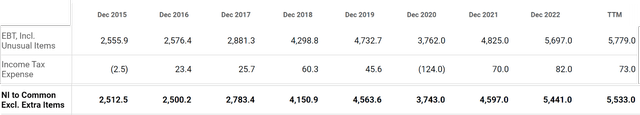

Let's first take a closer look at EPD's income statements and understand its tax structures a bit better. The first chart below shows the EBT and tax expenses for EPD (taken from the income statement provided by Seeking Alpha). As seen, its TTM EBT hovers around $5,779M and tax obligations around $73M, translating into an effective tax rate of 1.2% only. EPD benefits from such a low tax rate mainly due to its organizational structure as a master limited partnership ("MLP"). MLPs are designed to pass most of their income directly to their investors, which allows them to avoid corporate-level income taxes.

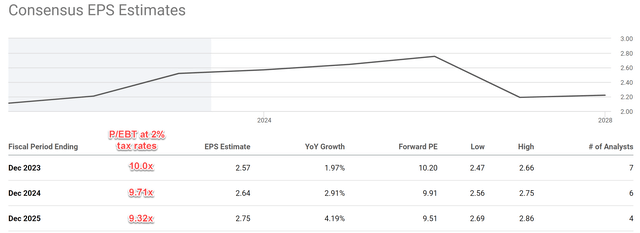

Overall, EPD effective tax rates are typically ranging from 1% to 2%. And in the chart below, I assumed a 2% tax rate for the next few to project its FWD EB T multiples. As seen, consensus estimates project EPD's EPS to be $2.57 in 2023 and $2.64 in 2024. With the 2% effective tax rate assumed, its EBT multiple turned out to be 10.0x at its current prices based on 2023 earnings and only 9.71x based on 2024 earnings. The multiple further contracts to 9.32 based on its 2025 earnings. As such, as argued above, the stock already offers 10% or above pretax returns at its current price even if its earnings completely stagnate.

Except that, it's very unlikely that its earnings will stagnate. As you can see from the chart below, the consensus is projecting earnings of about 3.5% of annual growth in the next 2 years (from $2.57 to $2.75 in 2 years). And next, I will analyze a few catalysts that could support such growth projections.

Source: Seeking Alpha data

Source: author based on Seeking Alpha data

EPD's near- and long-term growth catalysts

In the near term, with oil prices remaining near $75 a barrel, I expect production and transportation activities to remain robust in the U.S., providing support for EPD's profits. Natural gas prices have weakened a bit lately, but I won't be surprised if the price rebounds sharply in the coming months, for a few good reasons. First, as the hottest days of the summer approach, cooling needs would surge (and a major part of natural gas production is used to support electricity generation these days). At the same time, I also foresee natural gas liquid ("NGL") exports rising as Europe reduces imports from Russia with the Russian/Ukraine war dragging on.

In the longer term, EPD might benefit from a bolt-on acquisition or even be the target of acquisition itself. The pipeline industry is currently undergoing a period of major consolidation and reconstructing activities. Several major players in the pipeline industry are currently involved in mergers or acquisitions.

Notably, ONEOK recently agreed to take over Magellan with a combination of cash and stock valued at ~$19B. The acquisition, when/if completed, would result in a combined company with ~$60B enterprise value and more than 25 thousand miles of liquids-oriented pipelines. EPD is the long-time recognized scale leader in this space (with an $87B enterprise value as of this writing). However, the ONEOK-Magellan combo would become a close second (again, if/when the acquisition completes). As such, to maintain its leading scale, I view it as a very plausible move for EPD to consider a bolt-on acquisition with the robust cash flow it generates. Or as a more remote possibility, I see EPD itself being the target of an acquisition. A holding company named EPCO owns almost a third of its outstanding units and could buy EPD. Given the status of EPD in the sector, I believe the acquisition (if it happens at all, regardless of the buyer) would happen at a premium price.

Risks and final thoughts

The risks associated with EPD and the midstream sector have been the topic of numerous articles (including some of my own). Thus, I wouldn't reiterate these risks anymore here. Instead, I will focus on two risks that are directly relevant to the approach that I used in this article.

First, let me elaborate a little bit more on the issue of tax rates of EPD since this article relied heavily on pretax earnings. As aforementioned, EPD (and MLP in general) benefits from relatively low tax rates, typically ranging from 1% to 2%. MLPs are designed to pass most of their income directly to their investors, which allows them to avoid corporate-level income taxes. But the distribution of earnings is taxed at the individual unitholder's level - at their own income tax rate rather than at the corporate tax rate. Depending on your tax bracket, you might want to adjust the numbers I assumed.

Second, specific to the 10xEBT rule, as detailed in my blog article,

The 10x EBT rule does not mean every/any stock that is priced below 10x EBT is a good opportunity. As investors, two of the major risks we face include A) quality risk or value trap, i.e., paying a bargain price for something of horrible quality, and B) valuation risk, i.e., paying too much for something of superb quality (e.g., buying EPD in 2014 as analyze earlier). The 10x pretax rule is mainly to avoid the type B risk AFTER the type A risk has been eliminated already.

To conclude, I do not see any type A risks for EPD under current conditions either in the short- or mid-term. If you share this assessment, then EPD's current valuation also means type B risks are extremely low here. At its current valuation, it offers pretax earnings yields of at least 10% to start with. And I see catalysts that can sustain its earnings growth in the next few years, pushing the total annual return potential into the lower teens.

"fit" - Google News

May 22, 2023 at 06:51PM

https://ift.tt/ojh8DMK

Enterprise Products Partners: Perfect Fit To Buffett's 10xEBT Rule (NYSE:EPD) - Seeking Alpha

"fit" - Google News

https://ift.tt/FP0jAM6

https://ift.tt/aJDKEik

Bagikan Berita Ini

0 Response to "Enterprise Products Partners: Perfect Fit To Buffett's 10xEBT Rule (NYSE:EPD) - Seeking Alpha"

Post a Comment