(Bloomberg Opinion) -- Ahead of Friday's jobs report, evidence has grown to suggest that while total U.S. unemployment remains high, the manufacturing and construction industries may be poised for the kind of V-shaped recovery that we haven't seen in decades. This won't help the job prospects for bartenders in New York or San Francisco, or flight attendants waiting for air travel to return to pre-pandemic levels, but it does raise the possibility that the outlook for jobs may be better in 2021 than currently anticipated.

Slow labor-market recoveries in the recent past have occurred because of prolonged job slumps in goods-producing sectors. This time around, there are signs these areas are rebounding much more quickly, which could help buttress the economy and increase labor demand even while the pandemic health threat is still with us.

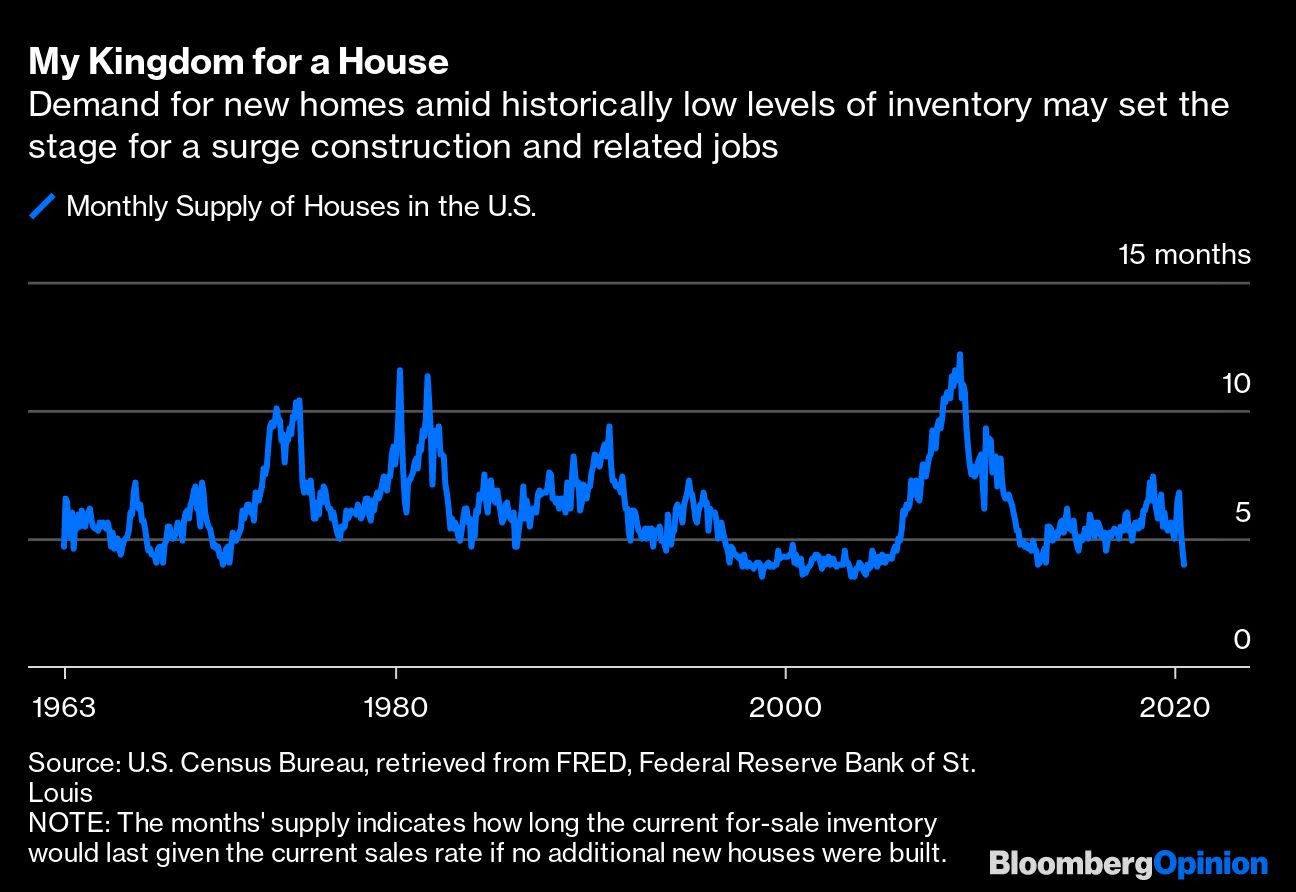

The best-appreciated aspect of this dynamic is the housing market, which began recovering quickly after shelter-in-place orders were lifted and continues to be robust. It's being driven by resilient buyer demand as households seek more space during the pandemic, as well as plunging inventory levels, historically-low mortgage rates and production that's struggling to keep pace. A U.S. government report on new home sales in July revealed that there was just four months’ supply of new homes for sale in the country during the month. This represents a historically low level of inventory, and the speed at which the gauge has fallen has been rapid as well.

Housing starts did rise sharply in July, but we may need production levels closer to the peak of the mid-2000's cycle to meet all the demand that's out there and get inventory up to more normalized levels. That will create a need not only for more construction workers, but also workers in factories that produce all the building materials, appliances, and furniture that go into new homes.

Elsewhere, manufacturing has taken a little bit longer to recover, but is arguably showing the kind of strength the housing market began exhibiting in late spring and early summer. Tuesday's ISM manufacturing report — a survey of business sentiment among factory owners — was stronger than expected, and confirmed not only the recovery in demand but the depleted level of inventories. The new orders component of the report rose to its highest level since 2004, suggesting healthy demand, while the customer inventories component came in at its lowest level since 2010, showing a need for companies to stock up after selling down what they owned over the past few months. The jobs component struggled to keep pace, and the report summary noted that safety restrictions were holding back employment levels, but the fact is, production needs to increase both to keep up with growing demand and to replenish depleted inventory levels.

Adding fuel to the fire has been the continued decline in the value of the dollar, in part due to the evolving policy framework of the Federal Reserve. As Fed Chair Jerome Powell noted at last week's Jackson Hole conference, the U.S. central bank is shifting to a framework under which it will target the average level of inflation over time, giving policy makers room to tolerate above-trend inflation for a while in response to periods of below-trend inflation. This is meant to give the labor market and economy more room to run before increasing interest rates. In the short term, this policy stance — perhaps combined with an improving global growth environment — is putting downward pressure on the dollar, which in turn makes U.S. exports more competitive on global markets.

V-shaped recoveries in manufacturing and construction would be significant because they’ve been at the root of slow labor rebounds in the past. Manufacturing employment never recovered the declines it sustained in the 2001 and 2008 recessions, and it took years for construction employment to recover after the bursting of the housing bubble. To the extent employment during the pandemic is suffering in service-sector industries such as dining and travel, it may only take the end of the public health crisis for those to normalize.

Low levels of inventories, growing demand, and a currency that makes U.S. exports more competitive globally than they've been for a while are all tailwinds for manufacturing and construction jobs in the months ahead. While the pandemic may keep in-person services activity subdued for many more months, this recovery in the goods-production sector should support economic growth in the meantime, and perhaps allow us to avoid the kind of years-long labor market recoveries that have become all too normal in recent cycles.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Conor Sen is a Bloomberg Opinion columnist. He has been a contributor to the Atlantic and Business Insider.

For more articles like this, please visit us at bloomberg.com/opinion

Subscribe now to stay ahead with the most trusted business news source.

©2020 Bloomberg L.P.

"Factory" - Google News

September 03, 2020 at 06:00PM

https://ift.tt/31UrazJ

An Epic Factory Jobs Boom Is on the Way - Yahoo Finance

"Factory" - Google News

https://ift.tt/2TEEPHn

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "An Epic Factory Jobs Boom Is on the Way - Yahoo Finance"

Post a Comment